24+ taxes mortgage interest

Web Most homeowners can deduct all of their mortgage interest. Web How to claim the mortgage interest deduction.

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

13 1987 your mortgage interest is fully tax deductible without limits.

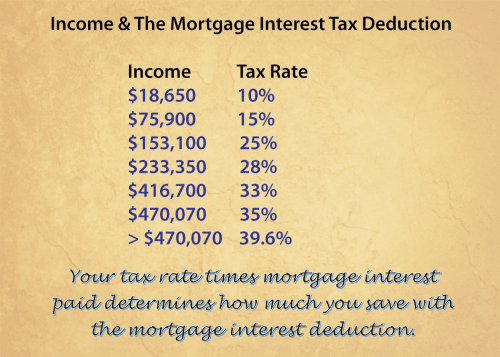

. As with property taxes you can deduct the interest on your mortgage for the portion of the year you owned your home. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. 2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Look in your mailbox for Form 1098. Web Tax break 1.

We dont make judgments or prescribe specific policies. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

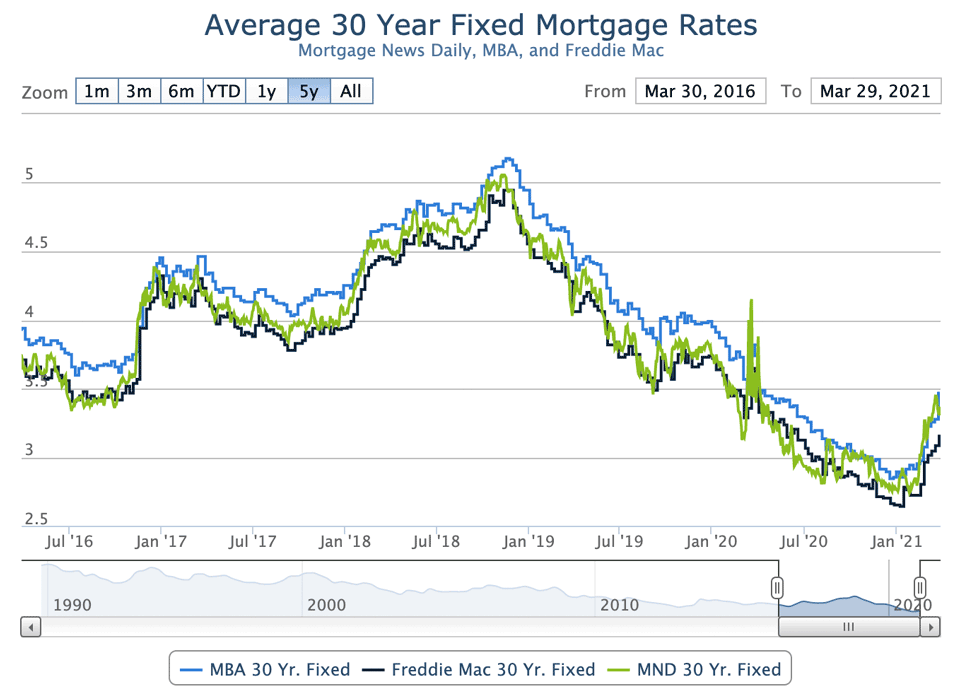

Todays Mortgage Rates Today the average APR for the. Web The mortgage interest tax deduction allows you to deduct the interest you pay on your mortgage from your income taxes. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web Then you only get back any withholding taken out. 16 2017 then its tax-deductible on. Get Instantly Matched With Your Ideal Mortgage Lender.

Single 12950 1750 or 65 and over or blind 14700 HOH. For 2022 the standard deduction amounts are. For tax years before 2018 you can also.

Answer Simple Questions About Your Life And We Do The Rest. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. In effect the government is paying homeowners to take on debt.

Ad Compare Loans Calculate Payments - All Online. Apply Get Pre-Approved Today. Ad Compare the Best Home Loans for March 2023.

Compare Home Financing Options Get Quotes. Web Under the Tax Cuts and Jobs Act of 2017 the limits decreased from 1 million to 750000 meaning the mortgage interest deduction can now be claimed on. Lock Your Rate Today.

Homeowners with a mortgage that went into effect before Dec. See what makes us different. Web At a personal tax rate of 24 this implies tax savings of 3566 in just the first year of the mortgage.

However higher limitations 1 million 500000 if married. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. Web If you took out your mortgage on or before Oct.

693751 or more. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec.

Web March 4 2022 439 pm ET. Web The mortgage interest deduction applies to different types of mortgage interest including interest charged monthly as part of your regular mortgage payment and points paid. 462501 693750.

Also if your mortgage balance is 750000. How much mortgage interest is tax deductible in. Web Mortgages that existed as of December 15 2017 will continue to receive the same tax treatment as under the old rules.

The amount you can deduct is limited but it can be a. 15 2017 can deduct interest on loans up to 1 million. Web Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages.

Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Web Mortgage interest. 190751 364200.

Your mortgage lender sends you a Form 1098 in January or early February. 364201 462500.

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

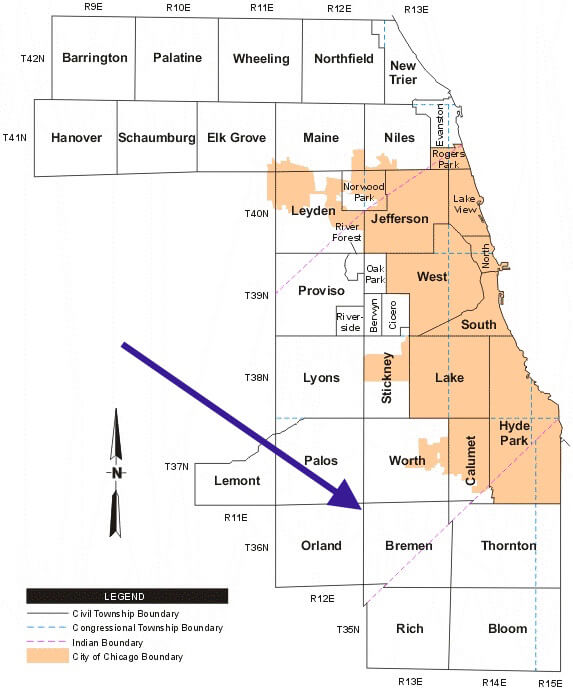

Suicidal Property Tax Rates And The Collapse Of Chicago S South Suburbs Wp Original Wirepoints

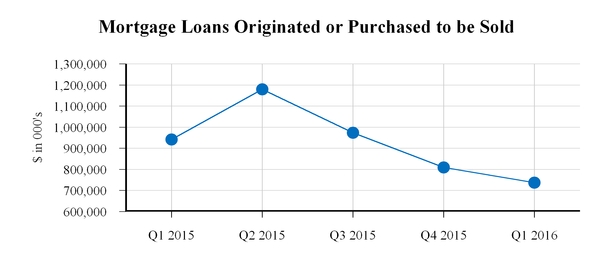

Exhibit

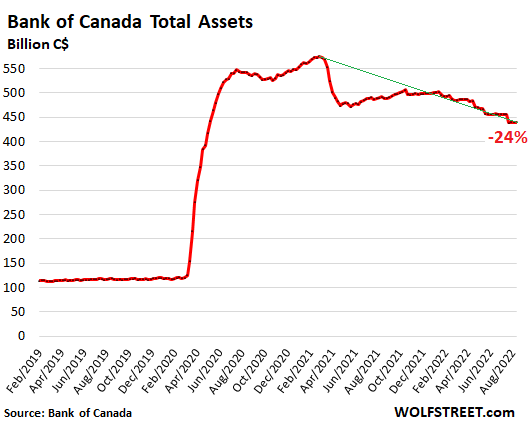

Qt At The Bank Of Canada Assets Down 24 From Peak Spiraling Losses On Bonds To Be Paid For By Canadians Wolf Street

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Keep The Mortgage For The Home Mortgage Interest Deduction

Trading De Credito Bonds Exercicio Previo Pdf Pdf Standard Poor S Earnings Before Interest

Mortgage Interest Deduction Rules Limits For 2023

Calculating The Home Mortgage Interest Deduction Hmid

Dxy Definition Financial Dictionary Fxmag Com

Mortgage Interest Deduction A Guide Rocket Mortgage

The Tcja S Cap On Mortgage Interest Deductions Tells Us That Taxes Matter Up To A Point Tax Policy Center

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Section 24 Interest Rate Relief How Does It Work Youtube

Mortgage Interest Rates Rise Inventory Falls Benchmark